Report: Smart clothing, glasses will grow fastest as 350M wearables ship in 2020

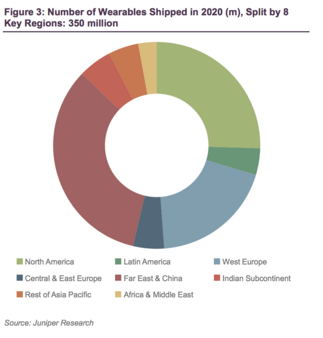

As wearables shipments hit 350 million in 2020 (up from 224 million in 2018), healthcare wearables are poised to bring in more revenue via subscription services than wearables in any other industry, according toa new report from Juniper Research.

The report uses AliveCor and Quell as examples of health wearables with a subscription business model, predicting that such companies will pull in $2.5 billion by 2022.

"A key challenge for wearables is to provide a concrete benefit or unique data," report authorJames Moar said in a statement."All our top growth segments either provide in-depth data from specialised form factors, or benefits that do not involve data at all.”

Juniper's methodology looks only at smart wearables (not old-school watches), and that count includes fitness bands, smartwatches, smart glasses, and smart clothing. Over the next two years, the latter two categories are expected to be the fastest growing segments, at 98 percent and 102 percent compound annual growth rate, respectively. The researchers say improvements in virtual reality and augmented reality technology will drive up smart glasses, and, similarly, improvements in smart textile technology will supercharge the smart clothing market.Juniper predicts 7 million smart clothing shipments by 2020 and nearly 30 million in 2022.

According to the report, the wearables market will be increasingly software-driven, since hardware is both increasingly commoditized and doesn't lend itself to sufficiently fast sales cycles.

"Consumer wearables companies rely heavily on hardware purchases for their revenues," Moar wrote in a whitepaper. "However consumers are not incentivised to regularly upgrade their devices in the same way as has historically been the case for smartphones. Fitbit’s repeat purchase rates for 2016 and three quarters of 2017 were only 36 percent of device sales, while the Apple Watch’s environmental guidelines indicate that the company expects devices to have three years of use by their first owners, which they consider a conservative estimate.

"This means that consumer wearables manufacturers, to maintain their levels of revenue, need to expand their market very aggressively in comparison to other sectors in the consumer electronics industry. As a result, companies that cannot grow at this rate will decline relatively rapidly, leaving the market to those that can either afford the marketing to promote their products to new audiences, can generate sufficient service revenue to support their bottom line, or can subsidise loss-making wearables departments with revenues from elsewhere," he wrote.

Other trends cited in the report include more wearables aimed at children and an increasingly large market for wearables in Asia, especially China, where Moar predicts 75 percent of shipments will be single-function fitness trackers, compared to 40 percent in North America and 50 percent in Western Europe.

byByJonah Comstock fromhttps://www.mobihealthnews.com/

Are you ready to upgrade for your clothing brand?

Welcome to contact us by sending an e-mail tosales@eleheat.com.cn

Eleheat will provide you professional One-Stop Solution for Smart Clothing.

Make you Clothing more Functional and Comfortable.